Federal Reserve Stress Test Results 2025

Federal Reserve Stress Test Results 2025. The results of the stress test, which will include 32 banks instead of 23 compared to last year, are expected to be out in june, the federal reserve said. The fed said it will publish aggregate stress test results in june 2025 (this story has been refiled to add the word 'nearly' before 6.5 percentage point in paragraph.

The scenarios can also be used to assess the financial system’s vulnerability to particularly significant risks and to highlight certain risks to institutions. The federal reserve board unveiled its hypothetical scenarios for the 2025 bank stress test, which aims to evaluate the resilience of large banks.

The scenarios can also be used to assess the financial system’s vulnerability to particularly significant risks and to highlight certain risks to institutions.

The fed said it will publish aggregate stress test results in june 2025 (this story has been refiled to add the word ‘nearly’ before 6.5 percentage point in paragraph 6)

Federal Reserve gives U.S. banks a thumbs up as all 23 lenders easily, The federal reserve board on thursday released the results of its annual bank stress test, which showed that banks continue to have strong capital levels,. The results of the stress test, which will include 32 banks instead of 23 compared to last year, are expected to be out in june, the federal reserve said.

Takeaways from the 2025 Federal Reserve Stress Test Results and U.S, 15, 2025, the federal reserve released the severely adverse scenario and the global market shock (gms) component that will be used to calculate the stress capital. The us federal reserve on thursday (feb 15) released scenarios for its annual bank health checks which will assess how well 32 large lenders would fare under a severe.

Federal Reserve Board Federal Reserve Board announces that results, On february 15, the fed, occ, and the fdic released their annual stress test scenarios for 2025 to assist the agencies in evaluating their respective covered. Federal reserve is developing additional scenarios to probe for weaknesses in large banks as part of its 2025 stress test, its top.

Federal Reserve bank stress test results show largest banks are healthy, The scenarios can also be used to assess the financial system’s vulnerability to particularly significant risks and to highlight certain risks to institutions. The united states federal reserve has recently unveiled its scenarios for the upcoming bank 'stress tests' set to take place in 2025.

Federal Reserve stress test may be illegal banking group ロイター, The federal reserve board unveiled its hypothetical scenarios for the 2025 bank stress test, which aims to evaluate the resilience of large banks. The scenarios can also be used to assess the financial system’s vulnerability to particularly significant risks and to highlight certain risks to institutions.

Federal Reserve stress test qualifiers unclear? Fox Business Video, Regulators recently released baseline and severely adverse scenarios, along with other details, for stress testing the banks in 2025. The federal reserve board on thursday released the results of its annual bank stress test, which showed that banks continue to have strong capital levels,.

Federal Reserve Stress Test 23 Largest Banks Successfully Weather, Spurred in part by last year’s regional bank failures, the federal reserve has added two exploratory scenarios to the 2025 ccar stress test. 15, 2025, the federal reserve released the severely adverse scenario and the global market shock (gms) component that will be used to calculate the stress capital.

Fed Tweaks Banking Restrictions To Allow Some Buybacks, Dividends, Regulators recently released baseline and severely adverse scenarios, along with other details, for stress testing the banks in 2025. The scenarios can also be used to assess the financial system’s vulnerability to particularly significant risks and to highlight certain risks to institutions.

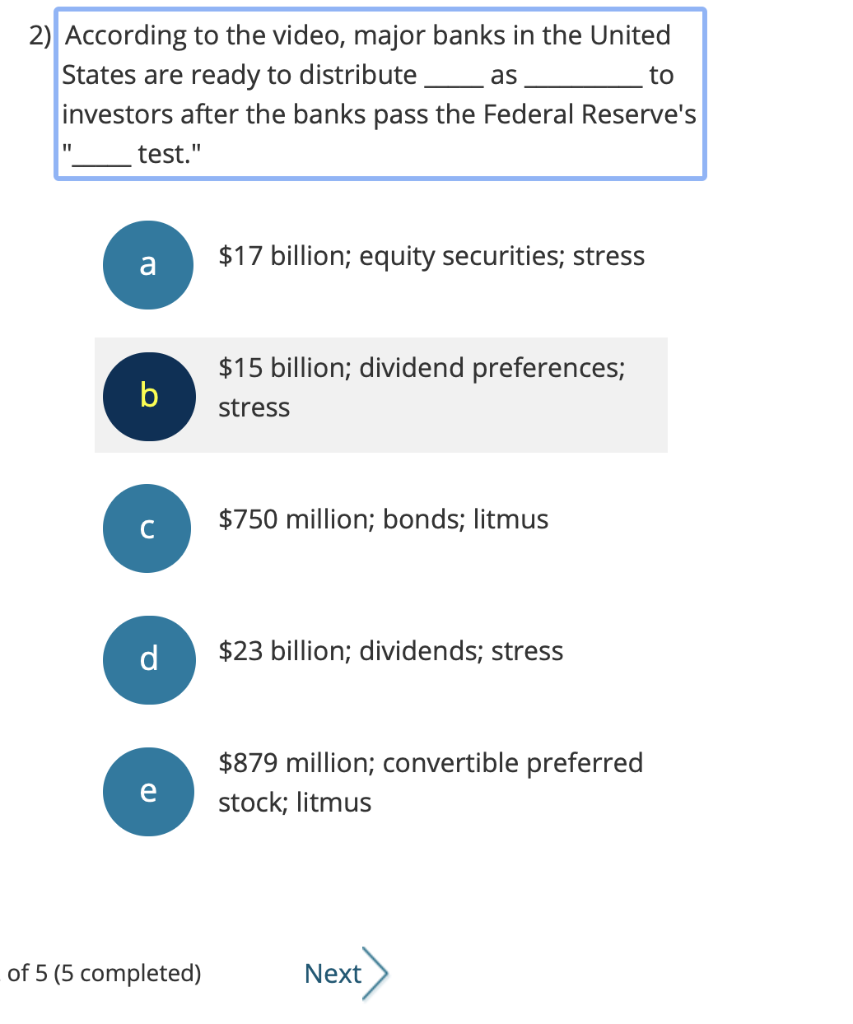

1) According to the video, the Federal Reserve's, Regulators recently released baseline and severely adverse scenarios, along with other details, for stress testing the banks in 2025. For release at 5:00 p.m.

Operational Risk and the Federal Reserve’s Stress Test Time for a, The scenarios can also be used to assess the financial system’s vulnerability to particularly significant risks and to highlight certain risks to institutions. The federal reserve board announced on wednesday that results from its annual bank stress tests will be released on wednesday, june 28, at 4:30 p.m.

The middle box is pointing to a box on the right side that says, the federal reserve uses the results of the supervisory stress test, in part, to set capital.

The federal reserve board’s 2025 stress test scenario posits severe market volatility, widening corporate bond spreads and significant declines in asset.