Pension Contribution Limits 2025

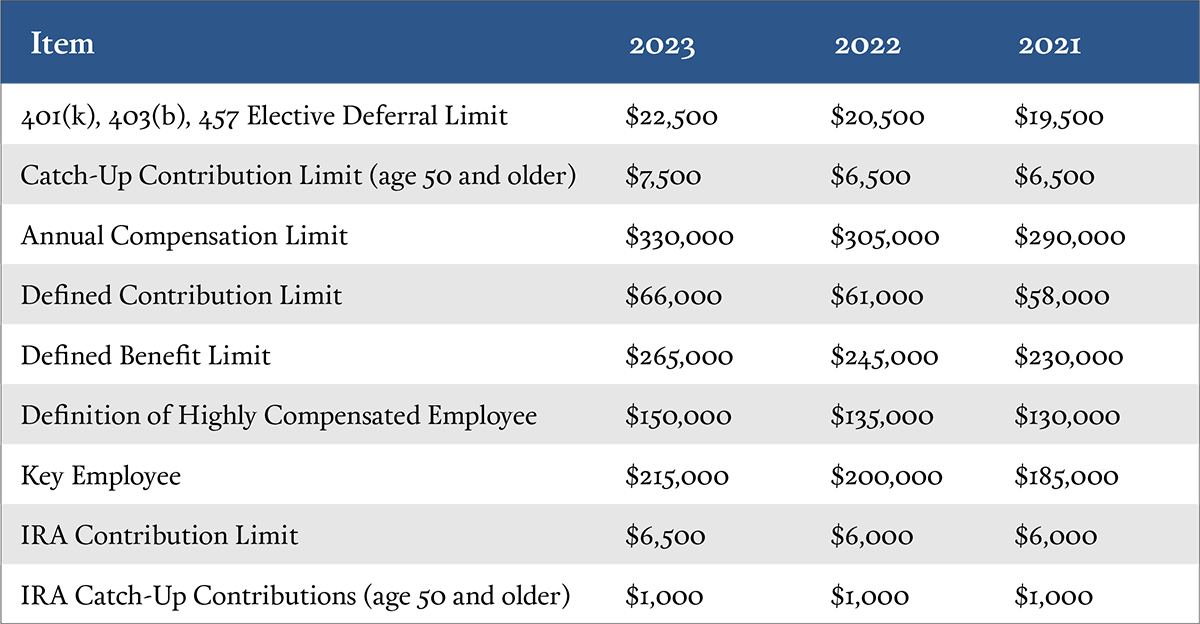

Pension Contribution Limits 2025. Defined contribution $66,000maximum limit, employee + employer (age 49 or younger) 3 $69,000 +$3,000 defined contribution maximum $73,500limit (age 50 or older), all. The 2025 limit on annual contributions to an ira will be $7,000, an increase from $6,500 in 2025.

Simple iras and simplified employee pension plans (seps) can allow employees to treat contributions as nondeductible roth contributions under act section. Join sentinel pension partner, melissa terito, and director, kasey melancon, as they explore hot topics in the retirement plan industry.

Effective january 1, 2025, the limitation on the annual benefit under a defined benefit plan under section 415(b)(1)(a) of the code is.

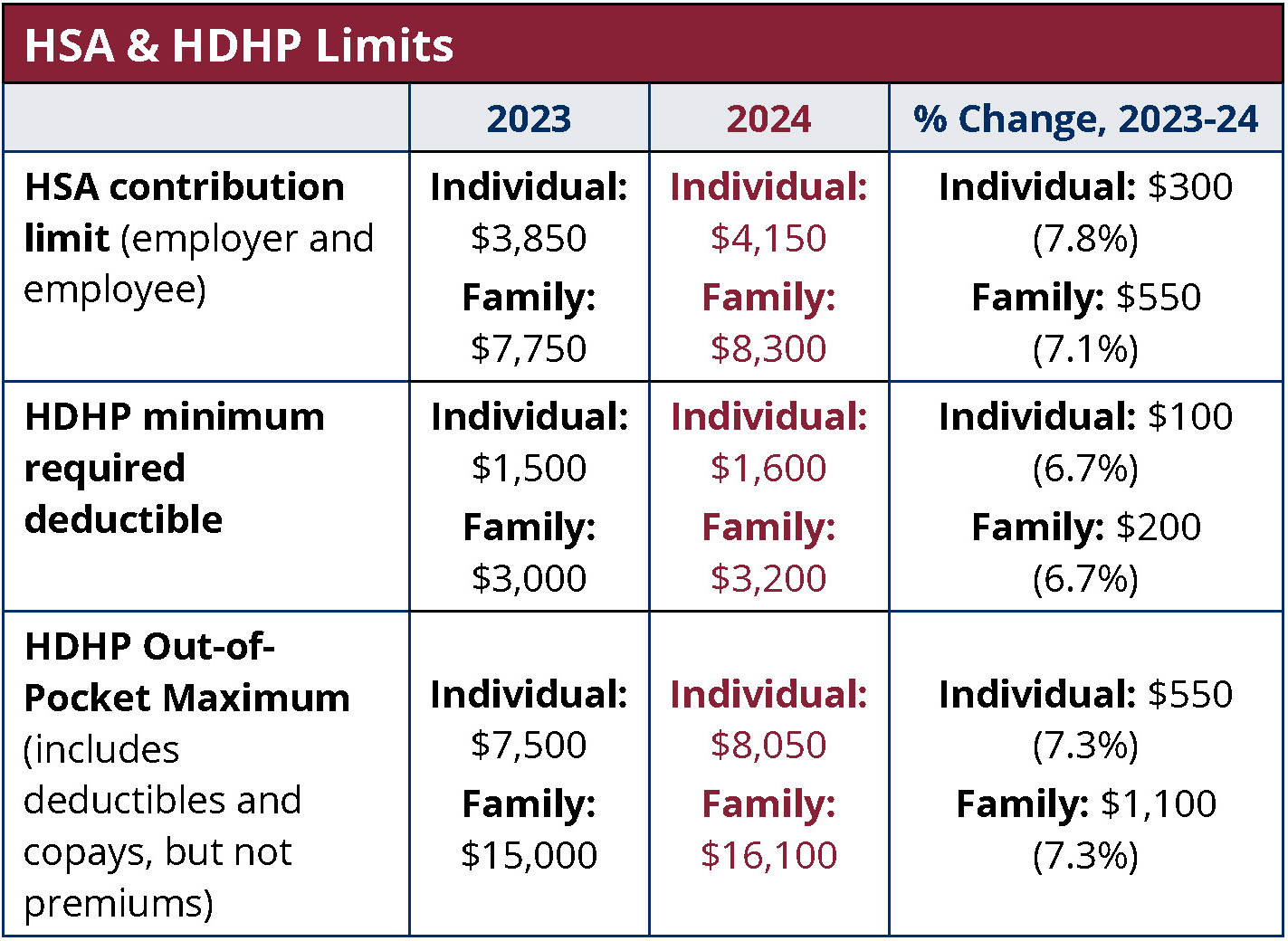

Significant HSA Contribution Limit Increase for 2025, Maximum benefit/contribution limits for 2019 through 2025, with a downloadable pdf of limits from 2014 to 2025. The new deferred profit sharing plan (dpsp) contribution.

401k 2025 Contribution Limit Chart, Maximum benefit/contribution limits for 2019 through 2025, with a downloadable pdf of limits from 2014 to 2025. 1, 2025, the limitation on the annual benefit under a defined benefit plan under section 415(b)(1)(a) of the code is increased from $265,000 to.

401(k) Contribution Limits for 2025, 2025, and Prior Years, On 6 march the chancellor of the exchequer, jeremy hunt, delivered the government’s spring budget 2025. 2025 pension contribution limits — available now.

Retirement Contribution Limits Financial Journey Partners in San Jose, When you pay money into a sipp, you receive income tax relief at your highest marginal rate. Simple iras and simplified employee pension plans (seps) can allow employees to treat contributions as nondeductible roth contributions under act section.

2025 Plan Contribution Limits Announced by IRS Abbeystreet, The new maximum registered retirement savings plan (rrsp) contribution limit will increase to $31,560. Additional highlights for 2025 the limit on annual contributions to an ira increased to $7,000 (up.

New IRS Indexed Limits for 2025 Aegis Retirement Aegis Retirement, On 6 march the chancellor of the exchequer, jeremy hunt, delivered the government’s spring budget 2025. Maximum employee elective deferral (age 49 or younger) 1 $23,000.

2025 HSA Contribution Limit Jumps Nearly 8 MedBen, Irs releases the qualified retirement plan limitations for 2025: 1, 2025, the limitation on the annual benefit under a defined benefit plan under section 415(b)(1)(a) of the code is increased from $265,000 to.

2025 Contribution Limits and Standard Deduction Announced — Day Hagan, Also, the income phaseout making a deducible contribution to a traditional ira,. On 6 march the chancellor of the exchequer, jeremy hunt, delivered the government’s spring budget 2025.

Retirement Plan Limits for 2025 Innovative CPA Group, The 2025 limit on annual contributions to an ira will be $7,000, an increase from $6,500 in 2025. When you pay money into a sipp, you receive income tax relief at your highest marginal rate.

Annual Retirement Plan Contribution Limits For 2025 Social(K), The cra has published the new maximum rpp and rrsp contribution limits for 2025, which will increase to $32,490 and $31,560, respectively the cra has announced the. Tax relief for employee pension contributions is subject to two main limits:

Maximum benefit/contribution limits for 2019 through 2025, with a downloadable pdf of limits from 2014 to 2025.

This chart lists the maximum amounts individuals are permitted to contribute to their retirement plans each year.